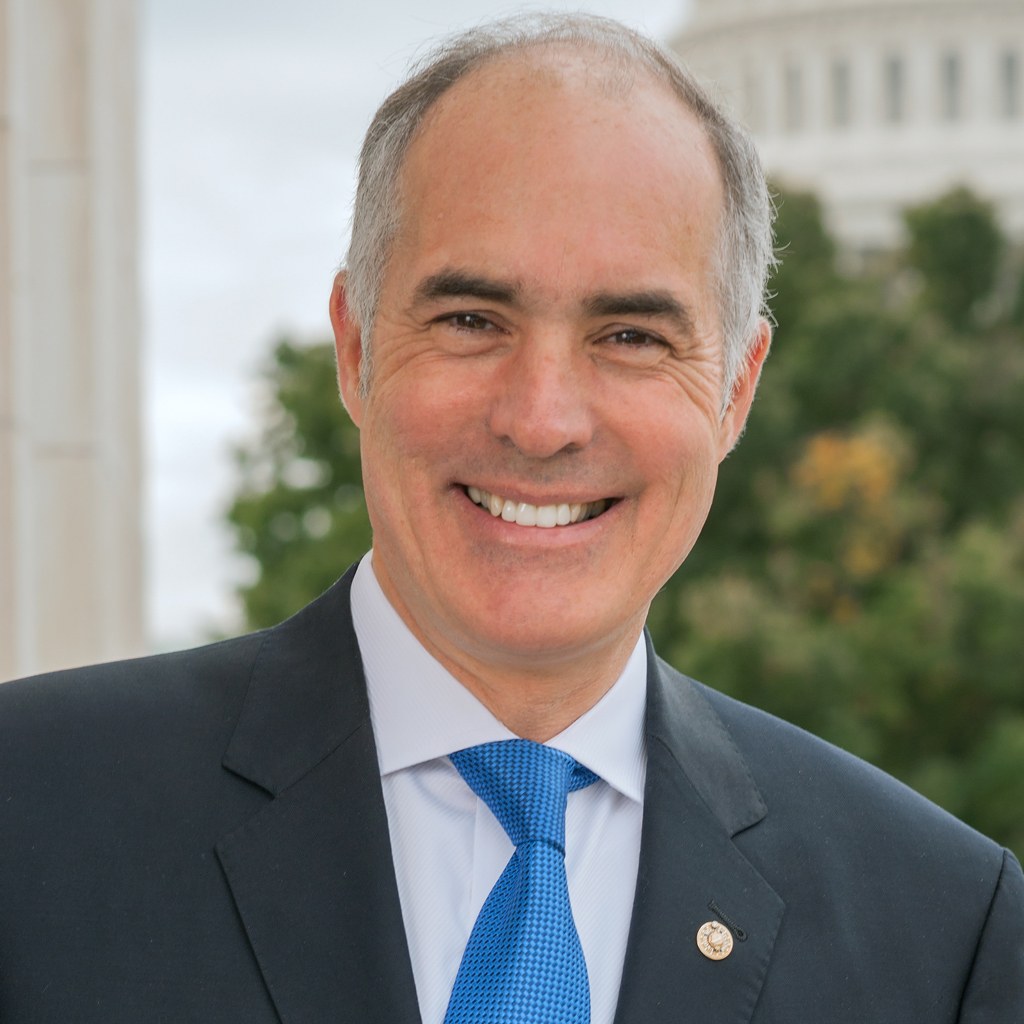

Congressional Spotlight: Senator Bob Casey (D-PA)

Each month The Nonprofit Alliance (TNPA) introduces you to a member of Congress who is a leader on legislative matters important to our TNPA community, with representation from both parties. TNPA had the opportunity to ask Senator Bob Casey (D-PA) a few questions. TNPA has enjoyed getting to know Senator Casey and looks forward to continuing to work closely with him.