Legislative Round-Up | July 2023

TNPA Takes the Hill on the Charitable Act

On July 19, The Nonprofit Alliance (TNPA) conducted another of its Capitol Hill Days. This one was special on two levels. It was TNPA’s first in-person Hill Day since the start of the COVID-19 pandemic — TNPA conducted six virtual Hill Days via Zoom meetings with members of Congress and their staffs between then and April 2023 — and it was TNPA’s first-ever Catholic Development Council (CDC) Hill Day, with members of the CDC joining us.

It was a whirlwind day on the Hill with a total of eight meetings in various Senate offices, all focusing on an issue critical to TNPA and the CDC — enactment of S. 566, the Charitable Act, which would provide a universal charitable deduction open to all taxpayers who contribute to charities regardless of their level of income.

The day started with a meeting in the office of Senator Chris Coons (D-DE), who, along with Senator James Lankford (R-OK), are the two lead sponsors of the Charitable Act. Following the meeting in Senator Coons office, attendees went to the offices of Senators – Pete Ricketts (R-NE), Todd Young (R-IN), Cynthia Lummis (R-WY), Tim Kaine (D-VA), and Jerry Moran (R-KS). All five of these Senators are potential future cosponsors of The Charitable Act, which already has 16 of the 100 Senators who have signed on to support the legislation.

Also, the group went to the office of Senator Jacky Rosen (D-NV), who is not only the most recent Senator to cosponsor the Charitable Act, but who was also an important supporter in the successful effort behind legislation to expand IRA Charitable Rollovers, which was signed into law by President Biden last December. The IRA Charitable Rollover expansion legislation not only increased the current maximum annual IRA Charitable Rollover (currently $100,000) by indexing it to inflation (as measured by the Consumer Price Index), but it allows seniors to use their IRA to fund a gift annuity, enabling middle-income seniors to make charitable contributions while maintaining retirement income. The final meeting of the day was in the office of Senator James Lankford, where attendees were able to provide a debrief on the day’s earlier meetings, along with strategizing on “next steps” to get the Charitable Act over the goal line and enacted into law. All in all, attendees got a fast-paced first-hand look at how Congress works!

Despite Recent Supreme Court Decision, Federal Student Loan Forgiveness is Still Important to Nonprofit Organizations

Despite last month’s US Supreme Court decision to strike down the Biden Administration’s plan to cancel up to $20,000 of student loan debt per borrower, the Public Service Loan Forgiveness (PSLF) program remains a powerful incentive for people to work in the charitable sector. Several improvements initiated earlier this month make the program more attractive to individuals interested in working in the nonprofit sector.

Specifically, on July 14, under the direction of President Biden, the U.S. Department of Education began notifying more than 800,000 borrowers under the PSLF that they have a total of $39 billion in federal student loans that will be automatically discharged — in effect, forgiven — in the coming weeks. The forthcoming discharges are the result of modifications implemented by the administration to ensure that all borrowers have an accurate count of the number of monthly payments that qualify toward forgiveness under “Income-Driven Repayment” plans or IDRs. IDRs base required monthly loan payments not on a fixed dollar amount, but on a percentage of current income. These efforts represent an effort by the administration to address historical failures in administering the student loan program, in which qualifying payments made under an IDR should have moved the borrower closer to forgiveness, but were not adequately accounted for.

The PSLF is an important recruiting tool for nonprofit organizations (NPOs) since it allows individuals who have ten years of full-time work for a designated 501(c)3 nonprofit organization and/or government entity (state, local, federal, or tribal), and have made student loan payments for 120 months (10 years), to be forgiven all remaining federal student loan debt.

The Patchwork Quilt of State Privacy Laws Continues to Expand

There are now nine states which have enacted state privacy statutes: California, Colorado, Connecticut, Iowa, Texas, Utah, and Virginia, with most recently, Montana and Oregon having enacted legislation. Legislation in Delaware has passed the legislature, and Governor John Carney has said he will shortly sign the measure into law. That would make a total of ten states. Of these ten states, Colorado, Delaware, and Oregon cover nonprofits. With most state legislatures having adjourned for the year, there will likely not be more states added to this list before year-end. However, in New York, privacy legislation, which would cover nonprofits, failed to be enacted by the early June deadline for such legislation. It appears that the effort to pass this legislation will again continue when the legislature reconvenes in January 2024.

The best possible outcome to the growing patchwork quilt of state privacy statutes would be for Congress to enact comprehensive, bipartisan national privacy legislation — likely taking several years to pass. Surprisingly, the ever-increasing list of state privacy laws has not seemed to “move the needle” in Congress toward a national privacy bill. TNPA continues working with Republicans and Democrats on Capitol Hill toward the passage of privacy legislation.

We continue to follow legislation in the states. Read more about new state laws and proposed state bills that could impact the work of the nonprofit sector by visiting TNPA’s State Legislation webpage.

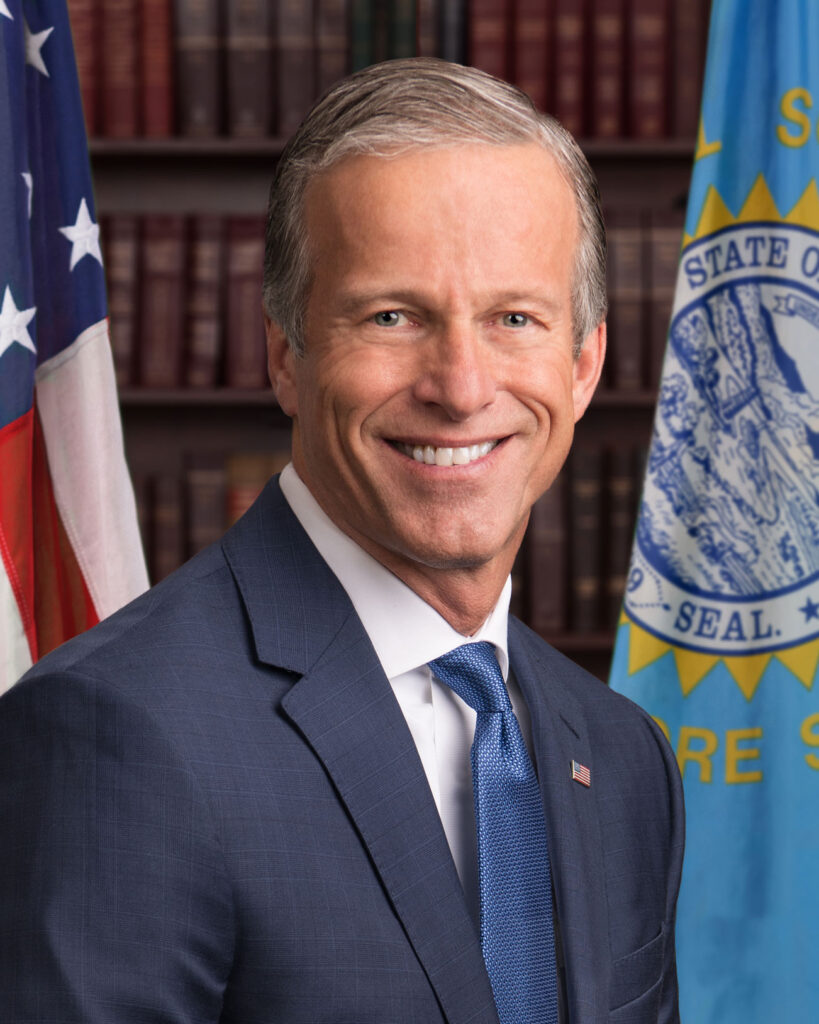

Congressional Spotlight: Senator John Thune (R-SD)

Each month TNPA introduces you to a member of Congress who is a leader on legislative matters important to our TNPA community, with representation from both parties.

Q&A with Senator John Thune

The Nonprofit Alliance has worked closely with Senator John Thune of South Dakota. TNPA had the opportunity to ask the Senator a few questions, and share them here:

What was the moment you realized you were serious about getting into public service?

The moment the door to public service opened to me was after a chance encounter with then U.S. Rep. Jim Abdnor in Murdo, South Dakota. I was in high school at the time, and it was after one of my basketball games. I made five out of six free-throws in that game, and when I later met Jim, he said, “I noticed you missed one.” Jim took an interest in me, like he did in so many others, because he genuinely liked people and wanted to see future leaders reach their potential. It was from that basketball game in small-town South Dakota that Jim and I began a decades-long friendship that would take me to Washington to work for him in the U.S. Senate and at the Small Business Administration under President Ronald Reagan.