The Journey to Enact Legislation with Mark Micali: Universal Charitable Deduction

Last week, on February 28, 2023, Senators James Lankford (R-OK) and Chris Coons (D-DE) introduced S. 566, The Charitable Act. The Senators’ legislation is the latest step on the long journey of the Universal Charitable Deduction, which expired over a year ago on December 31, 2021.

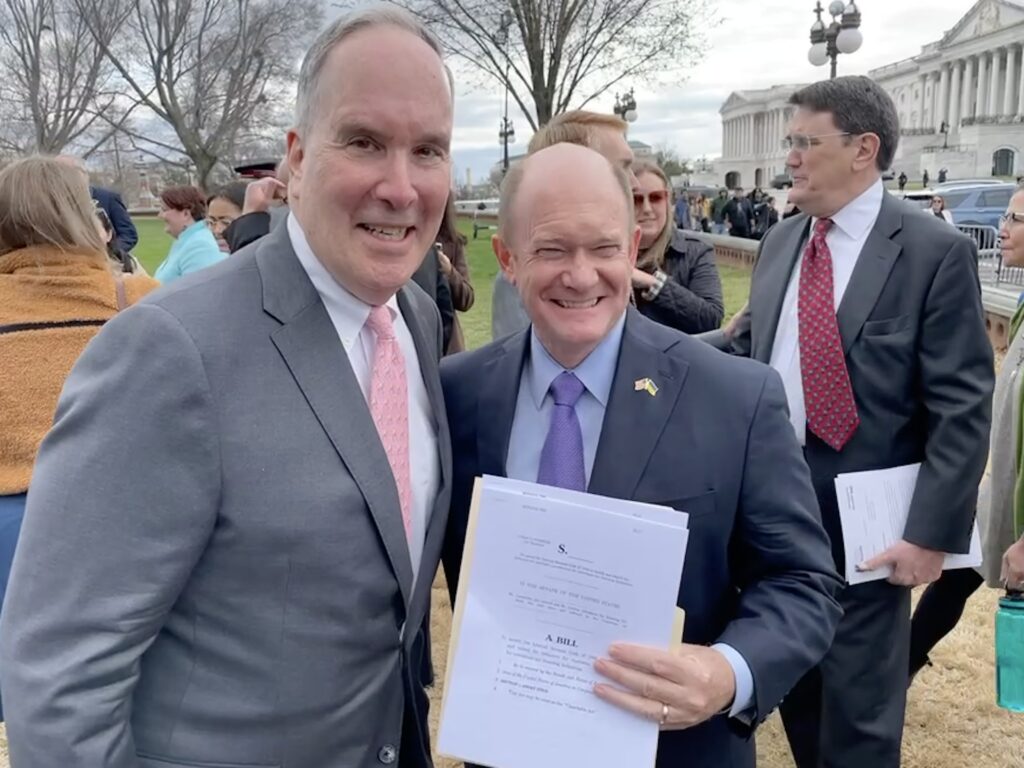

I attended the press conference introducing the legislation on February 28. It was held near the steps of the Senate side of the U.S. Capitol Building. I had a chance to chat with both Senators Lankford and Coons. I have been a lobbyist for the last 30 years (not to mention the six years previous to that working on Capitol Hill as a legislative aide),

and I can say without equivocation that I have never seen two Senators more committed to the passage of a piece of legislation than Senators Lankford and Coons on The Charitable Act. It was clear from the start of the press conference that this was anything but a “going through the motions” exercise in the hope of gaining some media attention. Rather, there was a palpable feeling that these two Senators mean business and are determined to get their legislation enacted into law.

The Charitable Act, a much simpler name than it’s predecessor’s “The Universal Giving Pandemic Response and Recovery Act,” is a bill that calls for a reinstatement of the Universal Charitable Deduction, a deduction open to all taxpayers regardless of their income level. Unlike previous years, this year’s proposed legislation would run for two years, 2023 and 2024, much improved over the previous legislation that ran for only one year. Also, this year’s bill proposes an aspirational rate for the deduction, allowing for up to 1/3 of the current Standard Deduction, which is $13,850 for single tax filers and $27,700 for married couples filing jointly. While we absolutely want to increase the amount of the deduction, TNPA and the two co-sponsoring Senators would be content with reinstating the universal deduction at its previous level of $600 for married couples and $300 for individuals.

My personal journey in the effort to get this legislation enacted started five years ago, back in 2018. It was triggered by the passage the year before, in 2017, of the Tax Cuts and Jobs Act (TCJA). TCJA effectively doubled the Standard Deduction to $12,000 for individual taxpayers and $24,000 for married couples filing jointly. (As noted previously, the Standard Deduction has since risen to $13,850 and $27,700 since it is tied to the Consumer Price Index or CPI.)

The change in the Standard Deduction created by the TCJA greatly reduced the number of taxpayers itemizing – and thus being able to claim a deduction when making a contribution to a 501(c)3 charity – from approximately 30% of taxpayers to only 12%. In effect, that means only 12% of taxpayers are eligible to receive a benefit when making a charitable contribution, while, without the Universal Charitable Deduction, 88% receive no benefit at all.

That takes us to a sunny day in 2018 when I ran into Senator Coons walking back to his Senate office in the Russell Senate Office Building. I mentioned how the TCJA had significantly reduced the number of taxpayers eligible to claim a charitable deduction. I began to make my pitch, and before I could complete my first sentence, Senator Coons said:

“Here’s how I see the issue, Mark. When I’m at my church in Delaware, and I make a contribution to the church, I’m allowed to claim a tax deduction. But that nice middle-income couple, who often sits next to us in church, gets no tax benefit for their support of the church.”

I replied, “Senator, that’s exactly the issue.”

After that brief encounter, I started to see momentum grow on Capitol Hill for the idea of a Universal Charitable Deduction open to all taxpayers, regardless of their income level. And what ultimately occurred was a teaming up of Senators Coons and Lankford to push for a Universal Charitable Deduction. Their efforts culminated in the passage of a Universal Charitable Deduction of $300 per taxpayer (regardless of whether filing as an individual or married couple) for the tax year 2020. This provision was signed into law in March 2020 as part of the CARES Act of 2020.

Then in December 2020, the Consolidated Appropriations Act of 2021 was signed into law, which included the Universal Charitable Deduction and increased it for 2021 to $600 for married couples filing jointly while maintaining the deduction at $300 for single taxpayers.

That Universal Charitable Deduction expired at the end of 2021. Throughout much of 2022, we remained hopeful. It appeared that Congress would adopt the so-called Tax Extenders Package, including our desired deduction. However, this package of 27 recently-expired tax provisions reached a partisan impasse when Democrats and Republicans could not come together on a compromise for the two most high-profile of the 27 expired tax provisions. Democrats wanted the Child Care Tax Credit extended. In contrast, Republicans wanted the Research & Development (R&D) tax credit extended. However, the cost of the Child Care Credit was six times the cost of the R&D credit, and the two parties could not reach a compromise.

As a result, the entire Tax Extenders Package went down in flames and was not adopted by Congress. That is how 2022 ended. And yes, we were frustrated that the Universal Charitable Deduction was not extended. We were, in effect, collateral damage to the failure to reach a compromise on the Child Care/R&D issue.

Fast forward to last week’s press conference, which was really a small-but important-piece of a very large puzzle. Quite a bit of behind-the-scenes work was done before the press conference. There were several meetings of the Charitable Giving Coalition with key congressional staff, particularly with the staffs of the two champions on the issue – Senators Lankford and Coons. The Charitable Giving Coalition is a group of over 60 charitable organizations, which have come together to support the Universal Charitable Deduction. TNPA has been a long-time member of the Coalition.

There was also the work of lining up additional Senators to cosponsor the legislation. In fact, in the last Congress, 19 of the 100 Senators had cosponsored the Lankford/Coons bill. So far in the current Congress, 11 Senators have signed on to The Charitable Act. We anticipate in the coming months that the number of cosponsors will ultimately exceed last year’s number of 19. That would be a real plus!

And what does it take to get Senators on the bill?

The short answer is a lot of determination and hard work. One of our most effective techniques has been to work to get the staff of a potential Senator co-sponsor to connect with the staff of either Lankford or Coons. Then when the potential new cosponsor seems interested, we ask either Senator to have a Senator-to-Senator conversation with the potential cosponsor. This technique has almost always worked.

And, of course, as the late House Speaker Tip O’Neill once said: “All politics is local.”

To demonstrate that a Senator’s constituents care about this, much work has gone into identifying charities in the state of a potential cosponsor and arranging a meeting between the charity and the Senator or their staff. Again, a very effective technique.

So now there is the critical question – How will we get the Universal Charitable Deduction reinstated?

Here we face a serious challenge due to the highly polarized, often partisan nature of politics today. Our best opportunity is to find a legislative vehicle, in effect, a “must pass” bill that has the support of both parties, to attach the Universal Charitable Deduction legislation as a rider. This could take the form of an important group of appropriations bills that have bipartisan support and are bundled together and could include the charitable deduction as an add-on. Or toward the end of the current fiscal year (September 30, 2023), when almost always Congress has to bundle together a number of funding provisions to avoid a government shutdown, the Universal Charitable Deduction could be attached.

The bottom line is the more Senators that line up to cosponsor The Charitable Act, the better chance we have to get it over the goal line. And, of course, the ultimate goal is to make the Universal Charitable Deduction permanent, rather than having to re-authorize it every year or two.

Stay tuned! We will be working diligently on this legislation.