Legislative Round-Up | February 2024

Once Again, We May Face a Government Shutdown

Whether Congress will agree to funding for the Federal Government to avoid a government shutdown is again a close call. The current short-term funding measure will run out for some government agencies at midnight on Friday, March 1, and funding for other parts of the government will run out at midnight on Friday, March 8. Keeping the government open and fully funded is vital to the nonprofit sector since the federal government is a provider of support to Americans in need, particularly in terms of food support and housing. Should the government shutdown, this will put even more strain on the already strained nonprofit sector to provide this vital assistance. TNPA continues to call on all members of Congress to resolve their political differences and keep the government open and funded.

New Jersey’s Daniel’s Law

This information was shared with TNPA members last week.

We are updating you on TNPA’s work on New Jersey’s Daniel’s Law, enacted in stages over the last four years, with the most problematic aspects in 2023. Unhappily, some of you have discovered the law the hard way – plaintiffs’ lawyers have recently sued you in the name of NJ police officers.

The nominal intent of the law is to enable law enforcement and criminal justice personnel to have their personal information (phone numbers and home addresses) quickly and easily removed from public access. But the overbroad reach and poor drafting of the law, and its private right of action, have made it a magnet for lawyers shopping for a windfall. The litigation, 130+ suits filed to date, does next to nothing to advance the important cause of protecting a police officer’s privacy. It will do plenty to enrich law firms while also imposing substantial costs on data businesses who, by any rational assessment, have done nothing to put police officers at risk.

The suits are filed ten business days after removal requests are sent, the time allotted for a response, to a firm’s privacy email address. On Day Zero, the requests are sent one request per email, 14,000 to 30,000 emails, one after the other. The approach virtually guarantees that no one can reply to all the requests within the ten days allotted.

We are in touch with firms being sued and lawyers representing them. We are also contacting the lawyers advising TNPA nonprofit and commercial members. Our purpose is to open lines of communication so that facts, tactics, and legal opinions might be shared.

The surest path to relief is legislative action to preserve the law’s purpose while repairing the elements that make the law a trial lawyer’s dream. To say this will be a hard go is an understatement. What legislator will want to be in the spotlight for tinkering with a law intended to protect law enforcement and justice system employees from real threats and actual harm?

We have reached out to people on the ground in NJ who believe there may be some chance, however slight, to get a quick legislative repair. We should know more about this soon. Meanwhile, we are in line to review curative legislative language. We will contact nonprofit members with a New Jersey presence to prepare the argument that the unintended harm they may suffer, such as limited mail contact with NJ residents, can be, and should be, easily prevented.

We will continue to update you with noteworthy developments.

The Wayfair Decision

What are the ramifications of the Wayfair decision?

The U.S. Supreme Court’s 2018 Wayfair decision changed everything from what had been a relatively straightforward set of rules governing interstate sales tax established by the U.S. Supreme Court’s 1992 Quill decision. Under Quill, the requirement as to whether an organization was subject to a particular state’s sales tax collection requirement was determined by physical presence – e.g., a store, office, or salespeople in a state.

Fast forward to the new rules established by the Wayfair decision. Under Wayfair, the old rule of physical nexus has been overturned and replaced by economic nexus. Each state now has the authority to decide what constitutes economic nexus in a state. For example, economic nexus can be triggered in some states by as little as mailing 100 pieces of mail into the state. Under this example, an organization would be required to collect that state’s sales tax, which is a very low bar. Also, 45 of the 50 states and the District of Columbia require sales tax collection. For a national mailer, it is a long list of states with which to comply.

What has TNPA done to help its members comply with Wayfair?

No one expected the U.S. Supreme Court’s Wayfair decision to be such a big topic of interest and discussion as we started 2024. TNPA was genuinely surprised to receive email after email from both agencies and nonprofits looking for clarification and guidance. To say the rules for complying with Wayfair are complicated is an understatement. They are confusing and challenging, and suppliers and partners can find themselves in the position of tax collectors. Given this complexity and the need for our members to stay a step ahead of challenging and difficult tax problems, on February 8, TNPA put together a Virtual Town Hall Meeting to provide some needed guidance. Over 220 participants attended the Town Hall.

To provide needed expertise for the Town Hall, TNPA had two attorneys from one of the country’s premier sales tax law firms, Brann & Isaacson. The two attorneys (Mr.) Marty Eisenstein and (Ms.) Jamie Szal are two highly credentialed tax experts from the firm.

The question of what is taxable and what is not?

Once again, the level of complexity is significant. Twenty-six states offer tax exemption from sales tax to nonprofit organizations (NPOs). However, there is no uniformity in terms of the rules as to how an NPO can claim a tax exemption. It varies from state to state. The relative ease of gaining a tax exemption certificate varies from state to state. It is relatively straightforward in some states, and in others, it is not.

To help navigate obtaining a tax exemption certificate, TNPA has identified vendors offering discounted rates for their services open to TNPA members. Contact Bob Tigner at rtigner@tnpa.org or Mark Micali at mmicali@tnpa.org, and you can be connected to one of the vendors.

Here are some resources to help nonprofits, partner agencies, and suppliers navigate the state-by-state sales tax requirements and pursue available exemptions and savings.

- Video replay of the February 8 Virtual Town Hall

- Presentation deck (long version) | These slides contain more text than the version used during the Town Hall and are meant to be kept and used as a standalone reference.

- State-by-state guide

For continued updates on Wayfair, you can visit our “The Wayfair Decision” webpage.

Further Legislation in the States

Read more about new state laws and proposed state bills that could impact the work of the nonprofit sector by visiting TNPA’s State Legislation webpage.

Around Capitol Hill in 90 Seconds with Mark Micali

February 2024 | Recorded: 2.2.2024

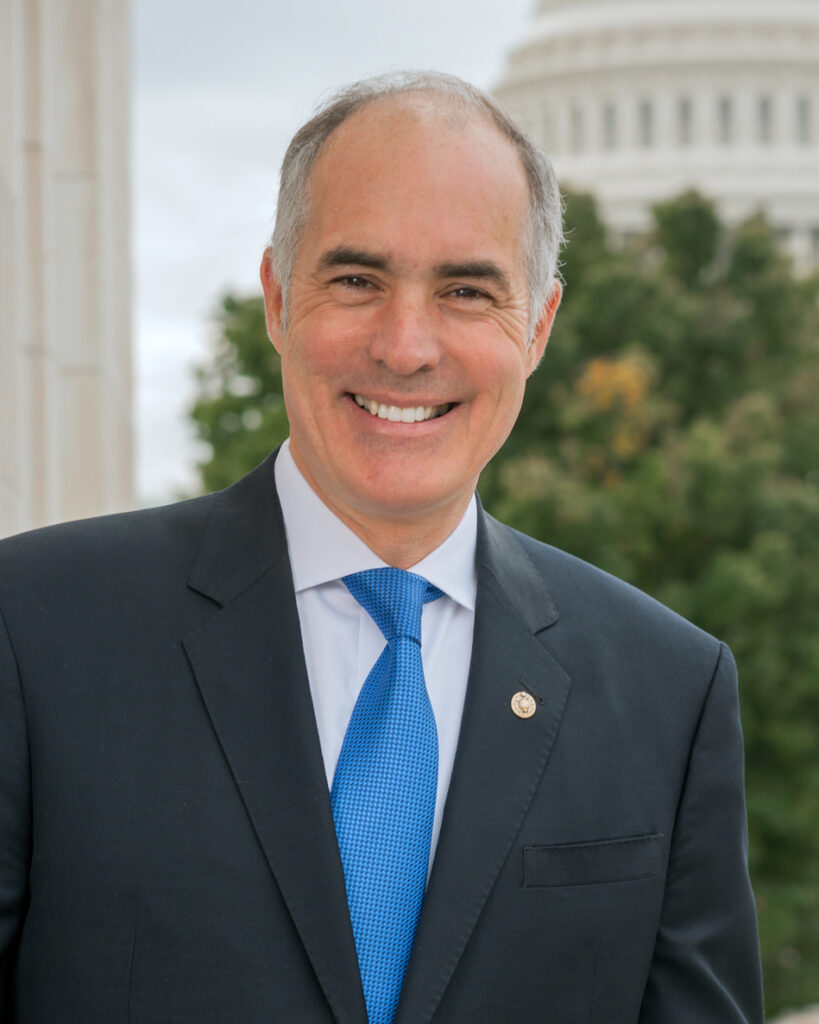

Congressional Spotlight: Senator Bob Casey (D-PA)

Each month TNPA introduces you to a member of Congress who is a leader on legislative matters important to our TNPA community, with representation from both parties.

Q&A with Senator Bob Casey

TNPA has worked closely with Senator Bob Casey of Pennsylvania. TNPA had the opportunity to ask the Senator a few questions, and share them here:

When was the moment you realized you were serious about getting into public service?

I have always known that I wanted to spend my life helping people and working to better the lives of my fellow Pennsylvanians. Much of my career has been guided by the inscription on the Finance Building in Harrisburg: “all public service is a trust, given in faith and accepted in honor.”

Advocacy Partners

Gold Sponsors

Bronze Sponsors

Are you interested in sponsoring TNPA’s advocacy program?

Contact Abby Graf at agraf@tnpa.org.