Legislative Round-Up | February 2022

Included in this Round-Up

- Postal: Brace for Big Postage Increase

- New York State AG Reaffirms Schedule B Filing Requirement

- Letter to the President: Pandemic & Workforce Shortage Relief

- From the States

Despite Likely Passage of Postal Reform Legislation, Nonprofit Mailers Must Brace for Big Postage Increase in July and Beyond

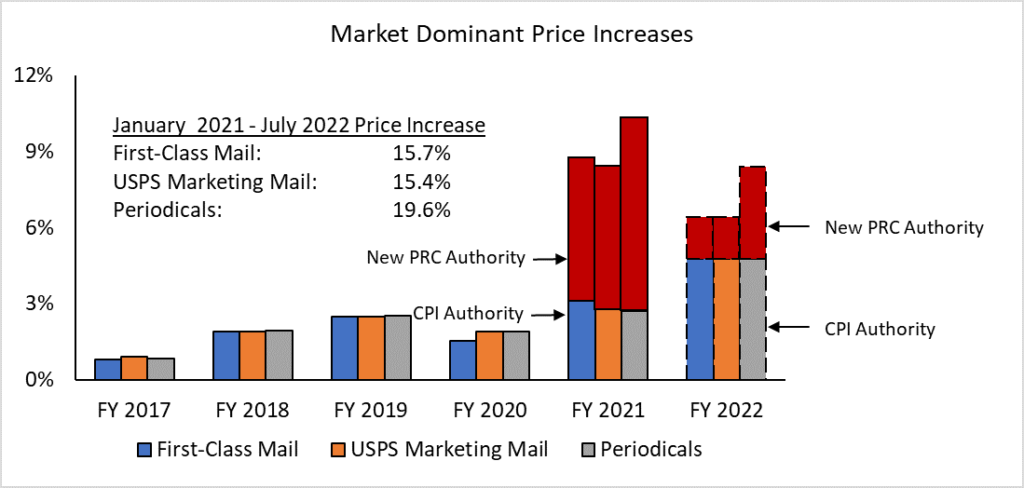

The Postal Service will raise postal rates another 6.4% to 8.4% (depending on the class of mail) this coming July. It’s little consolation but at least mailers can plan for the jolt.

These hefty increases were made possible when the Postal Regulatory Commission (PRC) granted the USPS a new rate authority in late 2020. The authority is an add-on to the previous system which permitted increases only up to a ceiling determined by the annual consumer price index (CPI), a measure of inflation.

The consequence is accumulated increases between 15.7 and 19.6% in a mere 18-month period (see the chart below). This can only be a severe shock to the system of any kind of mailer, and particularly so considering how stretched many nonprofits have been coping with the demands of the pandemic.

Image Credit: Alliance of Nonprofit Mailers, Stephen Kearney, steve@nonprofitmailers.org

The situation can only get worse if the status quo persists. USPS will enjoy this new add-on authority for another 3-4 years. When it has run its course, nonprofit mailers will have absorbed increases of 50-60% from start to finish.

In TNPA’s view, the rate add-on orchestrated by the PRC is not a solution to the Postal Service’s financial woes. Rather it is a symptom of them. Without substantial structural reform, there is not much hope the woes will do anything but get worse. To that end, TNPA will continue to work closely with other umbrella organizations representing nonprofit mailers. We have also joined an important coalition, Keep US Posted, a group of organizations have joined together to work for a reliable, affordable USPS.

With that as background, what does the February 8th passage by the House of Representatives of H.R. 3076, the Postal Reform Act of 2022 actually mean?

H.R. 3076 does have several positive provisions, including moving the large postal retiree healthcare cost off the Postal Service and putting it in Medicare where most retiree healthcare costs reside. However, the legislation does NOT have any language limiting future postal rate increases.

In the next few weeks, the Senate is expected to take up and pass H.R 3076. But should this legislation be enacted by Congress and signed into law by President Biden, the nonprofit sector—and for that matter all mailers—will continue to face postal rate increases well in excess of the rate of inflation for several years to come.

If we along with other mailers do not succeed at slowing future postal rate increases, it won’t be for lack of trying. TNPA strongly believes a long-term solution to endlessly skyrocketing rates can only be found by way of structural reform of the Postal Service and of its funding methods. Stated simply, an organization cannot successfully be “run as a business” while incorporating substantial—and obligatory—public service missions in its operations.

For a deeper analysis, please see our recent blog post.

TNPA Virtual Capitol Hill Day

Join Us!

Wednesday, March 2

This is a great opportunity to get a first-hand look at how Congress really works and strengthen our sector’s voice on Capitol Hill. Our meetings will focus on the universal charitable deduction and postal reform.

You don’t need to be an expert on specific legislation or the Congressional process … we cover that for you! First-timers welcome.

Click here to sign up for Hill Day (half-day options available).

New York State AG Reaffirms Schedule B Filing Requirement

The Charity Bureau of the NY AG’s office has proposed a regulation which would, once again, compel solicitation law registrants to submit a Form 990, Schedule B (or to submit alternative fundraising information). The AG claims it offers the proposal to “Amend filing requirement held unconstitutional” in Bonta, the closely-watched Supreme Court case involving Schedule B and donor privacy (TNPA organized and filed an influential amicus brief in the case, joined by 125 other nonprofits).

The AG’s rationale begs a question: Why not just abandon the Schedule B requirement altogether, rather than attempt to dance around the Supreme Court’s Bonta ruling protecting donor privacy? The new rule (effective date not yet clear) compels solicitation law filers to either (a) submit a redacted Schedule B showing only state of donor’s residence amount of gift or (b) report, under oath, the amount of money contributed by New Yorkers.

Given the obligation to report a verifiable amount raised in NY, the Schedule B option is bound to be less costly. But let’s say for sake of argument it costs the average filer $100 in staff time or outsourced work to prepare a scrubbed version. And let’s say only a third of NY’s 90,000 solicitation law registrants file a Schedule B. That’s $3 million (30,000 x 100) of nonprofit resources (i.e., donor dollars) next year and every year thereafter. This is the most recent, and glaring, instance in which states are indifferent to burdens imposed upon nonprofits.

Letter to President Biden and Congressional Leaders

Pandemic and Workforce Shortage Relief

On February 14, The Nonprofit Alliance joined more than 60 national charitable nonprofit organizations in signing a letter to President Biden and congressional leaders calling for “urgently needed pandemic and workforce shortage relief that will enable charitable organizations to fulfill their roles in our nation’s relief, recovery, and rebuilding.”

The letter identifies nonprofit-specific policy solutions that would provide disaster relief, address nonprofit workforce shortages, and promote volunteerism to aid our communities.

The letter is now open for all charitable organizations to sign and circulate to show Congress and the White House that nonprofits in local communities throughout the country support these priorities.

Review the letter and click here to add your nonprofit organization’s name.

From the States

We continue to follow legislation in many states. For more details and additional state bills that could impact the work of the nonprofit sector, as well as links to the actual bills, visit our States Policy page.