Increasing Mail Costs on the Horizon

Right now, the United States Postal Service (USPS) is considering increases in postal prices, which depending on the class of mail, will likely take effect in late June or early July. [NOTE from the Editor: TNPA makes it easy to write your members of Congress about this issue. Click here.]

This is on top of other numerous causes driving up costs.

The economic hardships caused by the global pandemic have only escalated demand pressures and uncertainty within the paper market and the United States Postal Service (USPS). We have seen some much-needed improvement, but the long-term impact of COVID-19 on 2021 marketing plans and the fundraising industry has yet to be fully determined.

PAPER MILLS

Paper mills have been shut down or converted to other work over the past year. In 2020, in the uncoated free sheet market, Domtar, North America’s leading uncoated free sheet manufacturer, reduced their overall capacity by 25 percent. In the coated free sheet market, Verso, a leading coated manufacturer, reduced their capacity by 40 percent.

As noted by Midland Paper National, paper mill shutdowns and conversions are significantly reducing paper supply year after year. Run rates at mills are up 90 percent due to capacity reductions, and input costs continue to increase from two to ten percent on raw materials, pulp, energy, and oil. The paper market continues to face demand pressures and uncertainty. The hope is that the mill shutdowns and conversions to significantly reduce supply will help to stabilize the market.

TRANSPORTATION

Transportation also remains a challenge for paper suppliers and the United States Postal Service. Demand has and is severely outpacing capacity as average haul rates have increased.

According to the American Trucking Association’s Truck Driver Shortage Analysis (2019), over the next decade the trucking industry will need to hire roughly 898,000 new drivers (90,000 drivers per year) to replace retiring truck drivers and keep up with industry growth. Because roughly 70 percent of all U.S. freight tonnage is moved by truck, any disruptions often impact entire supply chains. Freight costs continue to increase dramatically, trucking rates are doubling, and container costs are tripling.

This all means that by the end of Q1 2021, nonprofits can expect to see paper price increases of three to five percent for coated and uncoated paper. And, based on current feedback from paper mill partners, merchants, and market research, we should prepare to see another increase mid to late Q3 2021.

POSTAGE

The United States Postal Service (USPS) is an important conduit for the nonprofit community. A well-written letter with a personal message sent via the mail has been—and continues to be—a vital means of communication from nonprofits to donors, members, beneficiaries, and the general public.

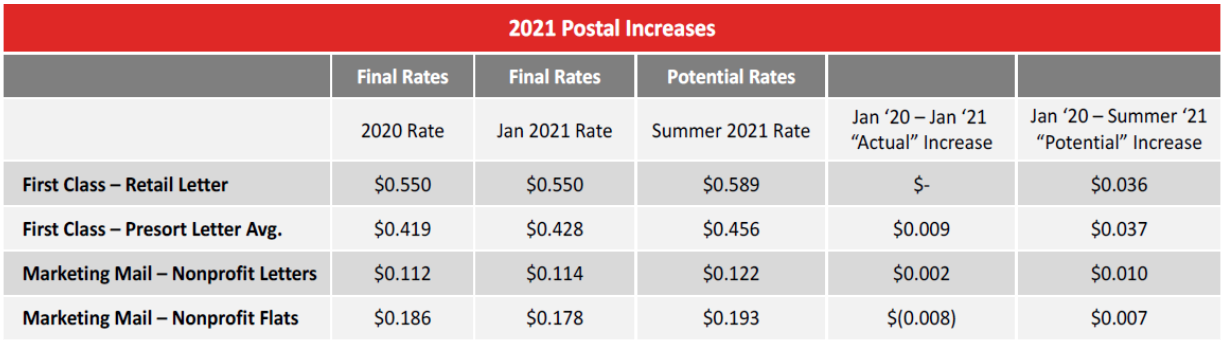

The USPS filed new rates with the Postal Regulatory Commission (PRC) for Market Dominant Rate Changes, and these rate changes went into effect in January 2021. This is a typical CPI (Consumer Price Index)-based rate change under the laws of the Postal Accountability and Enhancement Act (PAEA), which was signed into law in 2006 that means rate changes are calculated from a pool of potential changes based on the Consumer Price Index change over the prior year.

January 2021 highlights are:

- The cost of a single piece First Class stamp will remain at $0.55 (zero change)

- Single Piece Postcards – $0.35 to $0.36

- 1st Class Auto Presort is increasing 1.7 percent as a category. 5D 1 oz increase is .009

- 1st Class Auto Postcards are increasing 3.4 percent as a category. 5D increase is .009

- The increase to Nonprofit Letter mail is small – under 2 percent at the DSCF level and

- 1.4 percent at the Automation Category level.

- Nonprofit Auto Flats under 4 oz are going up 3.4 percent as a category

- DSCF 5D under 4 oz is going DOWN .008

- DNDC 5D under 4 oz going DOWN .01

The immediate concern is that the USPS is expected to announce its next rate increase very soon, which is expected to be 6% to 8.5%, depending on the class of mail. The new rates will likely take effect around 90 days later, in late June or early July.

What does this mean for you and your direct mail fundraising programs? You should expect to see an increase in the prices of packages, but that does not mean there are not ways to lessen the impact on your budgets and maximize your investment.

(This article is an excerpt from Overcoming Production Increases, which you can download here.)