A New Law Incentivizes Charitable Giving from Seniors

On December 29, the President signed into law the Consolidated Appropriations Act of 2023, which included the SECURE 2.0 Act of 2022 (“SECURE 2.0”).

SECURE 2.0 contains dozens of provisions aimed at encouraging additional retirement savings among Americans. We are excited to share that among SECURE 2.0’s provisions is a modified version of the Legacy IRA Act which will incentivize more charitable giving from seniors (Section 307).

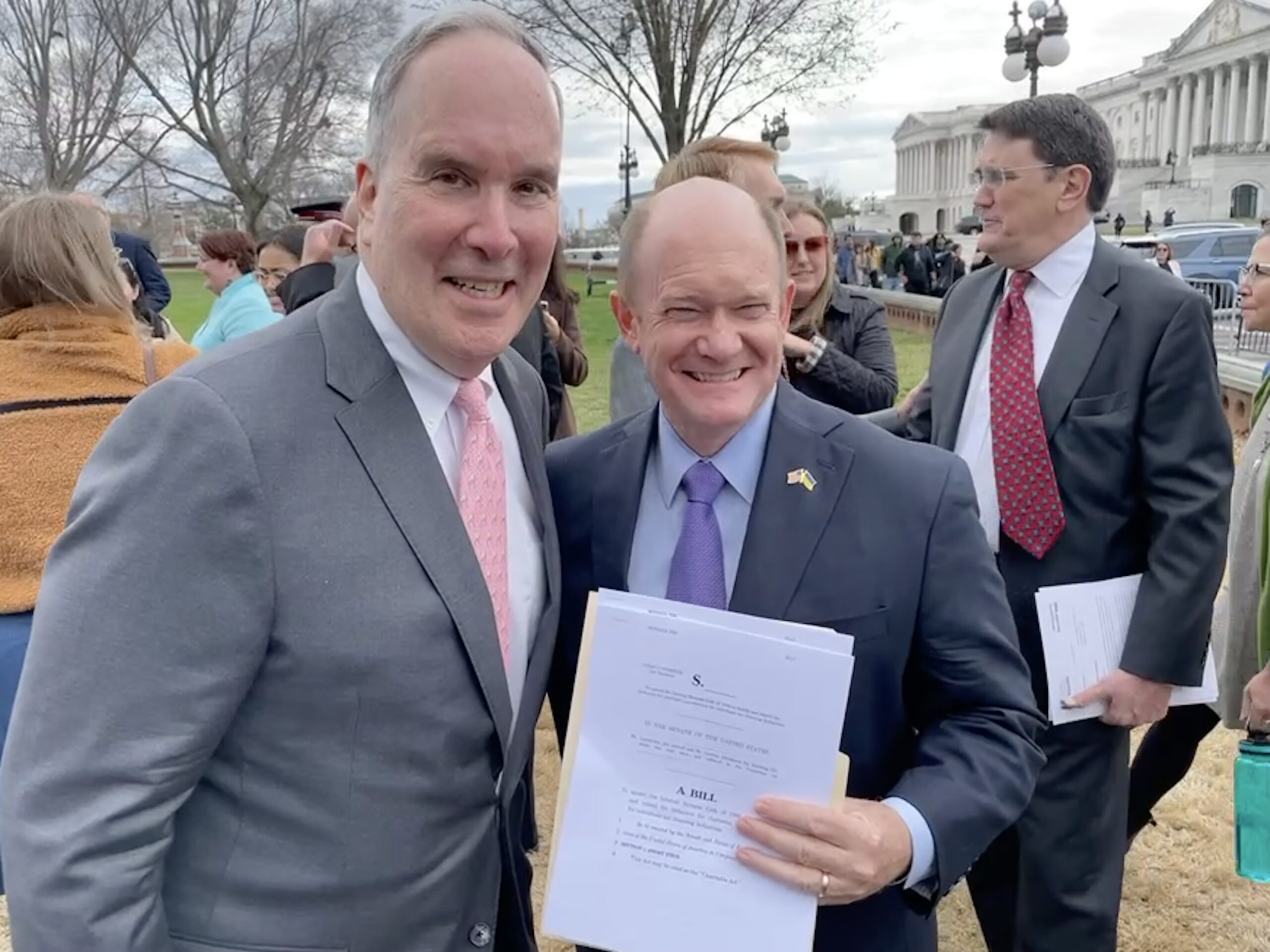

For the past few years, the American Heart Association has led a coalition of nearly 60 national charitable organizations, with a strong partnership from The Nonprofit Alliance, to pass the bipartisan Legacy IRA Act. The Legacy IRA Act is an enhancement and expansion of the IRA Charitable Rollover, which allows taxpayers age 70½ or older to transfer up to $100,000 annually from their IRA directly to a public charity without first having to recognize the distribution as income. It is the fastest-growing area of philanthropy.

This new change in law indexes the annual IRA Charitable Rollover cap for inflation and allows seniors to make a one-time IRA rollover gift to one or more charities to fund a life-income plan.

What does the change in law do?

Enhance the IRA Charitable Rollover: The law permanently indexes the existing IRA Charitable Rollover amount (currently at $100,000) starting in 2024. This will be the first increase in nearly 20 years.

Expand the IRA Charitable Rollover: The change in the law allows seniors starting at 70½ to contribute up to $50,000 from their traditional IRA account to charities to fund a charitable gift annuity, a charitable remainder annuity trust, or a charitable remainder unitrust.

The $50,000 cap can only be used in one calendar year, but within this one-year period, seniors can make gifts to multiple charities totaling $50,000. This distribution to one or more life-income gifts can be in addition to the existing $100,000 annual rollover cap.

The life-income provision took effect on January 1, 2023, and is permanent.

Why does the law matter to seniors?

- The law will help middle-income seniors who need a lifetime income and want to help a charity.

- It helps seniors who cannot afford to give away their retirement income during their lifetimes.

- Because these types of gifts allow seniors to exclude charitable distributions from income, seniors regardless of itemizing status will benefit from this important charitable giving incentive.

Why does the law matter to charities?

- The law will help charities receive more irrevocable planned gifts now.

- Many nonprofits are reliant on giving from seniors as 70- to 80-year-olds are the fastest-growing age bracket in the United States. It is expected that 10,000 Baby Boomers will turn 65 every day through 2030, and those over 65 now represent 15 percent of the total population.

- Seniors are the largest share of the donor base for many charities, and many nonprofits will continue to be reliant on giving from seniors.

- According to the Blackbaud Institute’s 2021 Charitable Giving Report, the average age of a U.S. donor is 65, and according to Blackbaud Institute’s 2018 The Next Generation of American Giving Report, Baby Boomers account for 41% of all current charitable donations.

More information can be found at the American Heart Association’s page at https://www.heart.org/en/get-involved/advocate/federal-priorities/nonprofit-support/legacy-ira-act.

Thank you again to The Nonprofit Alliance for your strong leadership in getting this change in law enacted.