2022-2023 ADRFCO Survey:

Compiling Insights into the Nonprofit Sector

Do you see any distinctions if you were to separate out the previous responses based on type of nonprofit client (ie., political/advocacy, etc.)?

- I have only once client at the moment so can’t really answer this.

- Yes. We have clients who are doing work in Ukraine. Their results have been excellent this year. Most other groups are struggling.

- Yes, food banks and other clients addressing basic needs had a stronger spike in response and revenue due to covid in 2020-21 –– and a sharper falloff in 2022.

- Yes, relief organizations continue to see upticks due to world events, while organizations in other sectors are seeing the declines with the COVID donors moving through into lapsed populations.

- I think non profits focused on food insecurity, mental health and homelessness are performing better than most

- Yes. Human Services performed well during the pandemic so are showing a sharper decline in 2022

- Lower dollar programs have been hit harder than those with strong ROI and upgrade strategies in place.

- Political advocacy clients were even — if not up.

- No, but it’s dependent on how aggressive management wants to be…

- Overall, animal welfare clients were more flat for the year while environmental clients were more down.

- Yes, collectively we saw a few clients even to slightly up over 2021, most down single digit percentages and 1 or 2 down double

- We are seeing a wide range of performance across our clients, with some continuing to have strong growth, some maintaining performance from 2021, but many reverting back to pre-pandemic levels. It does not seem to be sector dependent.

- Yes

- All are down, but advocacy seems hardest hit with my particular clients. Health and international relief are doing a bit better (but still seeing shortfalls).

- Yes! Local social service groups doing quite well … international relief doing well … cultural organizations struggling a bit.

- International sector/clients weren’t impacted due to Ukraine, they actually surpassed goals. Two other clients I work on our disease/health charities and they were right on track. Another, social service, did NOT meet goal.

- We have seen steeper declines among conservation clients. Considerably noticeable starting in August and September 2022, October and December were only slightly better in that revenue was flat year over year.

- Yes – Visitor based organizations experienced great results; healthcare clients generally saw declines (with exceptions); social service saw declines; conservation saw declines in acquisition rates

- food banks and human services saw declines compared to 2021 as expected. Enviro/conservation saw some declines. Animal, arts, international relief were pretty steady.

- yes, it’s all over the map. animal welfare and religious have done well, human services seem to be down.

Do you see any distinctions if you were to separate out the previous responses based on SIZE of nonprofit client (ie., under $1M, $1-5M, etc)?

- YES, my client is relatively small. For understandable business reasons the industry is not geared toward helping/supporting smaller organizations — and they usually need the most help.

- Yes — some of the smaller groups are doing quite well.

- Not determined

- No

- Not really, other than the fact that the larger non profits tend to be more advanced on their fundraising techniques.

- no

- Not really, though the larger organizations have more budget allocation to make changes, adjust strategies and therefore minimize some of the performance issues.

- No.

- Yes, the larger the budget the more likely to go for increases

- Smaller-sized clients seem to be more flat overall while larger clients were more down.

- No – size of non-profit didn’t seem to play a role

- No, although the smaller clients do have more variable results.

- Yes, but that’s because their mix of channels and efforts is different

- My bigger clients aren’t as afraid to risk an increased digital investment so that has helped them stay more resilient.

- Not necessarily, except the aforementioned international client is very large

- We so both small and larger orgs impacted.

- No real distinctions based on size

- not really

- most of my clients are under 1M and 1-5M but I didn’t separate that out.

What trends, patterns, or insights are standing out to you? Would you share any thoughts or experience addressing those trends?

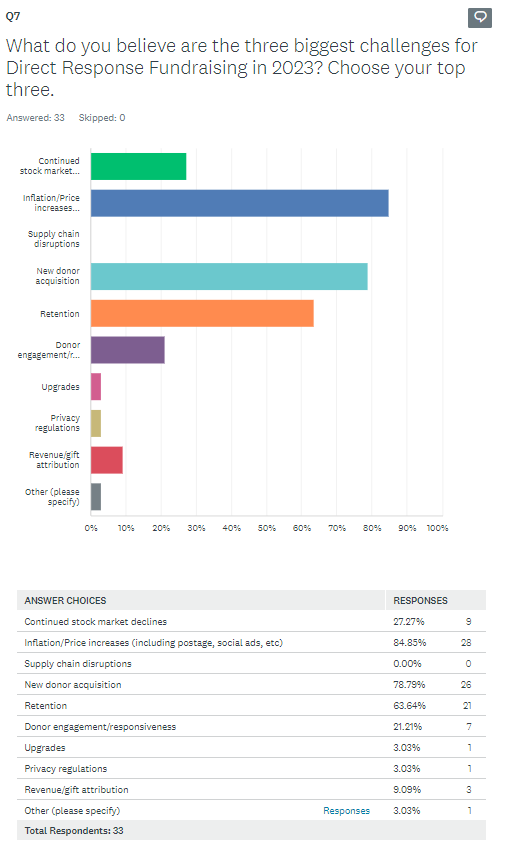

- Ours clients are getting fewer gifts but higher gift averages. Acquisition continues to be a challenge but we are encouraging our clients to maintain or increase their investments in acquisition, often adding more digital as well.

- With costs going up (postage a big part of that) as well as schedules being pushed out with continuing supply chain issues, non profits have to re-think what they’re putting in the mail and the effectiveness of simply doing what they’ve always done. They also have to start to realize the value of their digital marketing investment and the importance of tying it to their direct mail effort.

- acquisition response rates and 2nd year retention are showing huge drop offs. Suspecting donors that came on at the back end of the pandemic aren’t seeing the same level of urgency to retain

- Lower dollar donors are down. We’ve been focusing on prospects and donor retention on the higher avg gift prospects/donors. DAF giving is even with the prior years in # of gifts, but down in avg grant gift.

- Struggles in acquisition. Many of my clients were impacted in two different ways: 1) People are pinching their pennies due to the economy and less likely to start supporting a new organization. 2) The cost of production and/or supply chain issues made it difficult to access certain premiums — like labels — meaning organizations had to mail modified versions of their proven controls, often contributing to a softened response.

- higher average gifts, lower response.

- Direct mail is still the workhorse. Several clients have invested very heavily into social media marketing with big losses, against our counsel. “Following the shiny object”

- the end of November, December, early January trend up seems to be happening – hopefully it is a positive sign. Costs need to fall from projections and budgets. Renewal rates and the deep decline in new donor acquisition need to trend back toward even or better

- The biggest trend is that donor files continue to shrink while average gift and average donor value continues to increase.

- Such a big drop in $1,000+ gifts! I really miss those. I’m hoping some of these donors are switching to DAFs – we’re doing some upcoming analysis to see if we have the gifts but they just aren’t getting attributed.

- Organizations that have prioritized cultivation and stewardship, and have really deepened the engagement with their donors, are faring the best right now.

- Year End was tough, but most of any shortfall was made up for from gains earlier in the year, and it evened out. I don’t think the same will happen in 2023, we are likely going to start off where Year End left us, and we’ll need to play catch up

- While we definitely saw a leveling off or a return to normal after COVID lockdown boosted results, any declines in response were offset by increases in average gifts. We are no longer seeing the increases in average gifts make up for the shortfall in response so revenue in all channels is down.

- External factors (economic uncertainty, inflation, political, etc.) continued to have a greater impact than in the past. The job market and staff transitions was a real factor for nonprofits, disrupting strategy, budget, continuity of execution, etc.

- acquisition is especially challenging right now – lower response and higher costs. There are donor declines, which have been happening for a while, but exacerbated in my mind by the economic turmoil, inflation, stock market declines, IRS standard deduction.

- well, monthly giving should become even more prominent this year.